The Long Road Home: The 50-Year Mortgage Trap

By: Chloe Papadakis

From the fictional town of Cedar Valley, where characters from Quiet Echo continue to respond to real-world events.

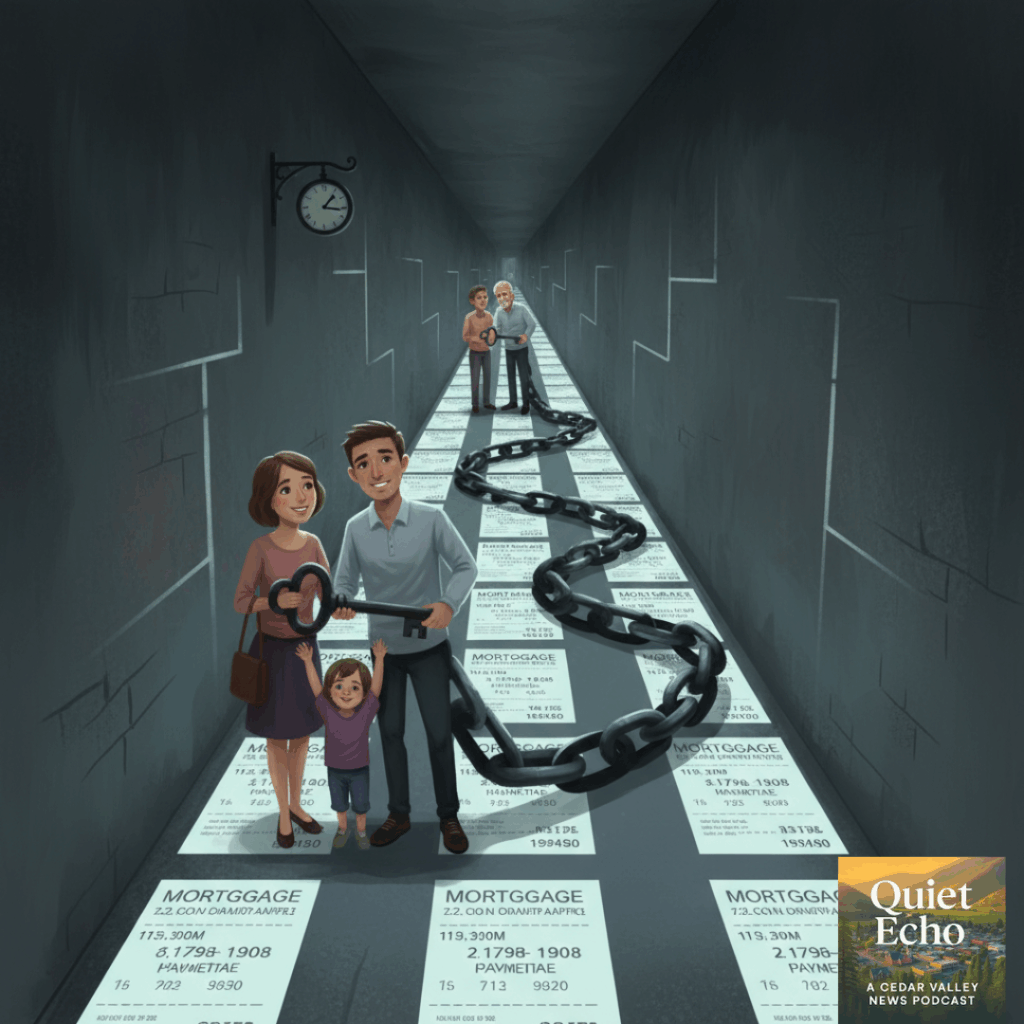

Some stories drift into view slowly, almost shy. Others land hard, like a bill in the mailbox you hoped would never arrive. The talk swirling around fifty-year mortgages feels a little like both. Folks hear “lower monthly payment” and breathe out with relief, only to realize the promise carries a long shadow stretching far beyond their own horizon.

Parents in Cedar Valley sit at kitchen tables long after dinner, pencils resting beside half-filled notebooks. A smaller payment sounds like safety. It hints at a chance to buy sooner, to stop renting, to finally claim a spot for children who dream of bedrooms they can decorate without asking permission. But once the numbers settle, a different truth rises. A fifty-year loan anchors a family to debt longer than some marriages last, longer than children stay home, longer than many working lives.

Our town knows something about long burdens. We watch neighbors carry quiet loads, smiling in public, worrying in private. A mortgage stretching across five decades becomes another weight pressing down on households already juggling groceries, childcare, rising taxes, car repairs, tuition hopes, and the fragile wish for a little peace. A fifty-year loan feels like a doorway left open only because all the better doors were locked.

When families choose to save instead, even modestly, every month becomes an act of courage. Two hundred dollars tucked away for ten years becomes a down payment with real muscle. It trims interest by hundreds of thousands. It shortens the path to ownership. It teaches discipline long before a lender ever speaks of terms. Savings build a future. Extra decades of interest drain one.

Young parents see this clearly. They want stability, not a financial chain tied to their ankles. They want to raise kids in homes paid off before those kids start their own lives. They want breathing room. They want futures where money grows in their own accounts instead of disappearing into a bank’s ledger for half a century.

Yes, the world feels expensive and uncertain. Yes, monthly payments scare families who are already stretched. But selling tomorrow to ease today rarely leads to the life anyone hoped to build. A home should shelter a family, not claim them. It should hold memories, not debt stretching past retirement.

When my daughter curls beside me on the couch, drifting to sleep after another story about brave heroes finding their way, I think about the world she will inherit. I worry about how many traps look like opportunities. I worry about how easily a comforting monthly number can hide a lifetime of cost. And I hope she grows up in a place where families believe in saving, patience, and choices that serve their future instead of sacrificing it.

A long road home should be a journey toward safety, not a sentence. Here in Cedar Valley, we know quick fixes rarely heal deep wounds. Families deserve homes they can own, not loans they can never outrun. Savings offer a quieter path, but it leads somewhere solid.

Sometimes the slow way forward becomes the only way freedom grows.

This editorial is part of the fictional Cedar Valley News series. While the people and town are fictional, the national events they reflect on are real.

It’s free, live, and fresh! Quiet Echo—A Cedar Valley News Podcast is live on Apple Podcasts: https://bit.ly/4nV8XsE, Spotify: https://bit.ly/4hdNHfX, YouTube: https://bit.ly/48Zfu1g , and Podcastle: https://bit.ly/4pYRstE. Every day, you can hear Cedar Valley’s editorials read aloud by the voices you’ve come to know—warm, steady, and rooted in the values we share. Step into the rhythm of our town, one short reflection at a time. Wherever you listen, you’ll feel right at home. Presented by the Readers and Writers Book Club: https://bit.ly/3KLTyg4